2013 market outlook: Roads and transportation

What is in this article?

2013 market outlook: Roads and transportation

The U.S. transportation construction infrastructure market is expected to show modest growth in 2013, increasing 3 percent, from $126.5 billion to $130.3 billion, according to the American Road & Transportation Builder’s Association’s annual economic forecast, released in last November.

Growth is expected in the areas of highway and street pavements, airport terminal and runway work, railroads, and port and waterway construction. The bridge market, which has shown substantial growth over the last 10 years, is predicted to remain flat this year.

The Federal Surface Transportation program, along with state and local government transportation investments, are the most significant drivers of the national transportation infrastructure construction market.

Transportation infrastructure construction market forecast

Source: ARTBA forecast of U.S. Census Bureau Value of Construction Put in Place

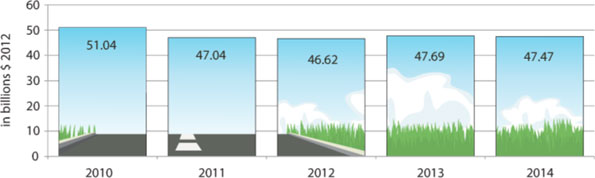

Real value of highway & street pavement work*

* Reflect adjustments to account for inflation

Source: ARTBA forecast of U.S. Census Bureau Value of Construction Put in Place

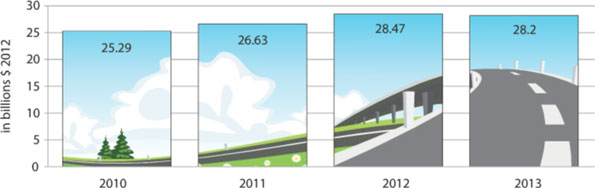

Growth in bridge activity for 2013

Source: ARTBA 2013 Forecast

Historical spending data from U.S. Census Bureau Value of Construction Put in Place, adjusted with ARTBA Price Index 2013 Forecast assumes continued modest economic recovery and material prices in line with general inflation.

MAP-21’s impacts

The pavements market will be sluggish in 2013, growing 2.8 percent to $58.4 billion. This includes $47.7 billion in public and private investment in highways, roads and streets.

With no new federal funding in the 2012 MAP-21 surface transportation law, still-recovering state and local tax collections and modest new housing starts, the pavements market will be uneven across the nation. Pavement work is anticipated to be down in 25 states. Growth above a 5 percent range is expected in 19 states. Major markets California and Texas will be down slightly from 2012, but will actually be returning to a normal baseline level because of several major project awards over the past several years.

At least two developments related to MAP-21 could lead to additional, short-term construction market activity in the sector and strengthen the market in 2013 and 2014. First, the law’s restructuring of the federal highway program offers state transportation departments more flexibility in their use of federal funds. This could result in slightly increased investment in highway, bridge and pavement work above the forecast in some states. Second, MAP-21’s expanded federal Transportation Infrastructure Finance & Innovation Act (TIFIA) loan program could also boost construction activity.

Also, while the economic costs of Hurricane Sandy are still being calculated, it’s fair to say that major reconstruction work along the East Coast in states affected by the storm will also be a market factor in 2013 across all modes. Additional federal, state and local emergency funds for rebuilding this infrastructure will be a boost as projects get underway.